Why Holding On Until "Break-Even" Could Cost You More Than You Think

Why Fixating on Cost Basis During Market Volatility Could Be Costing You More Than You Realize—and How Rebalancing Can Save Your Portfolio

The recent market volatility has spared no one. Over the past couple of months, I’ve had countless conversations with clients who tell me something like this: “I don’t mind if my investments has dropped, as long as I don’t sell below what I paid. I’ll just wait until it gets back to the original price.” On the surface, this sounds logical—no one wants to lose money. But this mindset hides a dangerous blind spot that could quietly sabotage your long-term goals.

The “Break-Even” Trap: Why Your Brain Loves Cost Basis

Imagine you buy a stock for ₹1,000. A year later, it soars to ₹1,500. You feel like a genius. But then it drops to ₹1,200. Even though you’re still up ₹200, you “lost” ₹300 from the peak. Yet, many investors in this situation say, “At least I’m still above what I paid. I’ll sell when it hits ₹1,500 again.”

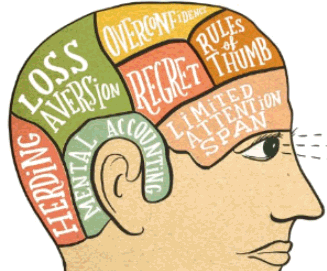

This is mental accounting in action. Your brain fixates on the original purchase price (₹1,000) as a safety net. As long as you’re above that number, losses from the peak feel less “real.” But here’s the problem: money has no memory. The market doesn’t care what you paid—it only cares about what your investments are worth today and where they could go tomorrow.

People often tell me, “Rishab, in the long run, my losses will be recovered, and I’ll earn the average returns this asset class has historically delivered.” My go-to response—true to my Economics roots—is, “In the long run, we’re all dead.”

Now, don’t get me wrong—staying invested is one of the most powerful ways to build wealth. But staying invested blindly, without aligning it to your goals, risk tolerance, and time horizon—and while being tangled in a web of behavioral biases—isn’t exactly a winning strategy.

The Hidden Cost of Waiting to “Break Even”

Let’s say your ₹1,000 investment drops to ₹800. You decide to hold until it returns to ₹1,000. But while you wait:

Opportunity cost piles up: That ₹800 could be invested elsewhere. If the rest of your portfolio grows 7% a year, you’re missing out on gains.

Time eats into goals: If you’re saving for a home or retirement, waiting years to break even delays your timeline. In the worst case scenario, you’ll have to postpone your goals or compromise on it.

The market moves on: The stock might never recover. Companies like Yes Bank never returned to their peaks—investors who held on lost everything.

Market volatility can be unsettling, but it’s also an opportunity to reassess your portfolio and make strategic adjustments. At Sabiduria Capital, we help clients navigate these turbulent times by focusing on disciplined rebalancing and aligning investments with long-term goals. If you’re unsure how to handle the current market swings, visit www.sabiduriacapital.com to learn more about our professional money management services. Leave a comment down below to talk to our team.

Real-Life Example: The 2024 Small-Cap Craze

In 2024, small-cap stocks went on a tear. Many investors let their small-cap holdings grow to 30–40% of their portfolios, far beyond their original plan and risk capacity. When markets corrected in 2025, those who didn’t rebalance lost 20–30% or even more.

One client told me: “I didn’t sell my small caps because they were still above what I paid. I thought I was being patient.” But by not trimming when prices were high, they missed the chance to lock in gains and protect their portfolio.

But, no one can predict the top? So, how to sell/trim your portfolio?

That’s a fair question—and one of the most common dilemmas investors face. The truth is, trying to time the market perfectly is a game even professionals struggle to win. And basing your investment decisions on predictions or gut feelings can quickly derail your long-term goals.

The smarter, more sustainable approach is to anchor your strategy in a mix of goals-based and rules-based investing. Here’s what that means:

Goals-based investing ensures that your portfolio is built around your personal financial objectives—be it buying a home, funding your child’s education, or retiring comfortably. Your investment decisions are tied to what you need, not what the market is doing.

Rules-based investing brings in structure and discipline. This means having predefined rules around asset allocation, rebalancing, trimming positions, or even exiting certain investments—regardless of market hype or fear.

Rebalancing ≠ Market Timing (Here’s Why)

“Rebalancing” sounds complicated, but it’s just adjusting your portfolio to stay on track. Think of it like weeding a garden: if one plant grows too big, it might block sunlight from the others. Trimming it back helps everything grow healthier.

In 2024, rebalancing would have meant:

Selling some small caps after their big run-up.

Using that money to buy undervalued assets (like bonds or large-cap stocks).

This isn’t about predicting the market—it’s about sticking to a plan. Discipline is what saves investors from themselves.

What You Can Do Today

If you’re an investor reeling with uncertainty during this volatile phase of the market, here are some practical tips that you can act on:

Shift your focus from “what I paid” to “what I need”

Instead of asking, “Is this investment above my cost?” ask:“Is this still the best place for my money?”

“Does this align with my goals for the next 5 years?”

Set automatic rebalancing check-ins

Every 6 months, review your portfolio. If any investment is more than 10% above your target allocation, trim it.Talk about opportunity costs

If you catch yourself saying, “I’ll sell when it gets back to my price,” see the math:“Waiting 2 years to break even costs you ₹X in potential growth elsewhere.”

Final Takeaway: Money Has No Pride

Your cost basis is just a number from the past. What matters is what your money can do for you now. Holding onto investments purely to “break even” is like refusing to sell a damaged car until it’s repaired—even if the repair costs more than the car’s value.

Next time the market tests your patience, ask yourself: “Am I holding this investment because it’s good for my future, or because I don’t want to admit I lost ₹X?”

As I remind my clients: The goal isn’t to be right about every investment—it’s to be right about your future (Not my words, but sane advice nevertheless).

If you’re feeling overwhelmed by the current market volatility and unsure how to navigate these uncertain times, Sabiduria Capital is here to help.

We specialize in managing investments with a disciplined, research-driven approach that focuses on long-term wealth creation while mitigating risks.

Whether it’s rebalancing your portfolio, identifying opportunities amid market turbulence, or simply providing peace of mind, we’ve got you covered.

Visit us at www.sabiduriacapital.com or leave a comment below to start the conversation about how we can help you achieve your financial goals.