Stop Chasing Returns: The Power of Downside Capture in Smarter Mutual Fund Selection

Discover why focusing on downside protection—not just past performance—can transform your investment outcomes.

Picture this: You're comparing two mutual funds.

Fund A shows 15% annual returns, while Fund B shows 13%. Easy choice, right? Fund A wins! But what if I told you that when markets crashed last year, Fund A lost 25% while Fund B only dropped 12%? Suddenly, that extra 2% return doesn't seem worth the sleepless nights during market turmoil.

Welcome to the first article in my series on "Beyond Returns: What Really Matters When Choosing Mutual Funds." Today, we're diving deep into one of the most overlooked yet crucial metrics in fund evaluation: the downside capture ratio.

The Returns Trap: Why Headlines Lie

Most investors make fund selection decisions based primarily on historical returns data. It's simple, straightforward, and heavily marketed by fund houses. However, this approach is fundamentally flawed because it tells only half the story. Returns data shows you what happened when everything went well, but it masks how the fund behaved when markets turned ugly.

The downside capture ratio measures how well an investment manager performs relative to a benchmark index during periods of market decline. It's calculated by dividing the fund's returns by the benchmark returns during down-markets and multiplying by 100. A ratio below 100% indicates the fund fell less than its benchmark during market downturns, providing crucial downside protection.

Real-World Examples: Large Cap Funds Under the Microscope

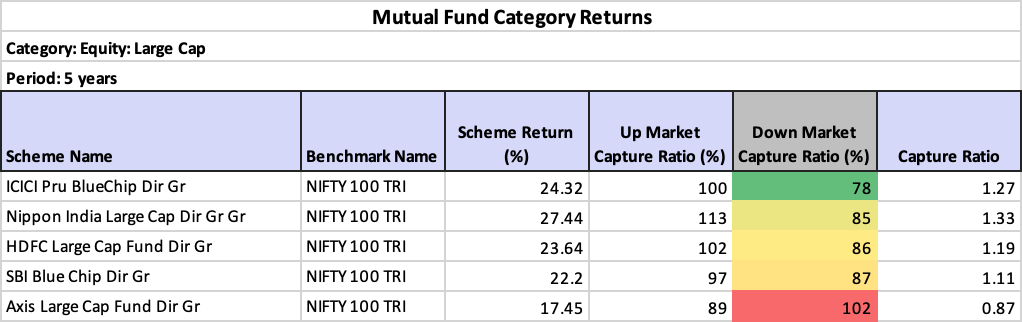

Let's examine some prominent large-cap funds to understand how downside capture reveals hidden truths about fund performance.

HDFC Large Cap Fund serves as an excellent case study. Over a 3-year period, this fund achieved an impressive alpha of 4.61, significantly outperforming its benchmark. However, the real story emerges when we examine its market capture ratios. The fund demonstrates an up-market capture ratio of 103.76%, indicating strong performance during rising markets. More importantly, its down-market capture ratio of 78.8% reveals its defensive characteristics, falling significantly less than the benchmark during market downturns.

Compare this with SBI Bluechip Fund, which shows a downside capture ratio of 93.01%. While still providing some downside protection, this fund captures a much larger portion of market declines compared to the HDFC Large Cap Fund. For risk-averse investors, this 15 percentage point difference in downside capture could mean the difference between sleeping soundly and losing sleep during market volatility.

Over a period of 5 years, we see that ICICI Bluechip fund performed the best in terms of Downside capture, but ranked 2nd in terms of historical returns. Nippon Large Cap Fund, on the other hand ranked 1st in terms of historical returns, but 2nd in terms of downside market capture.

Across time horizons of 1, 3, 5 and 10 years, we will see the rankings amongst the same fund will differ in terms of returns and the downside capture ratios. Fund selection in that case will be discussed in details later during the series once we have covered the various parameters against which a fund can be judged.

Mid-Cap Funds: Where Downside Protection Becomes Critical

Mid-cap funds typically exhibit higher volatility, making downside capture ratios even more crucial for evaluation. The data reveals fascinating insights about how different fund managers navigate turbulent markets.

HDFC Mid-Cap Opportunities Fund stands out with exceptional downside protection characteristics. The fund exhibits a downside capture ratio of 74.72%, meaning it typically falls only about 75% as much as its benchmark during market declines. This defensive positioning has translated into consistent downside protection, with the fund showing 96% downside protection consistency over 3 years, 98% over 4 years, and 100% over 5 years when compared to the Nifty Midcap 100.

Axis Midcap Fund provides another compelling example with a down-market capture ratio of 75%. This means that if the benchmark index declined by 1% in a given month, the fund's NAV typically fell by only 0.75%. Despite this conservative approach during downturns, the fund has demonstrated remarkable long-term wealth creation, with a ₹1 lakh investment at inception growing to over ₹10 lakhs by May 2024.

The Mathematics of Risk: Why Small Differences Matter Enormously

To understand why downside capture ratios matter so much, consider this mathematical reality: a 20% loss requires a 25% gain to break even, while a 50% loss demands a 100% gain for recovery. This asymmetric nature of losses versus gains makes downside protection exponentially more valuable than marginal upside capture.

When comparing funds, a difference of even 10-15 percentage points in downside capture can translate to significantly different investor experiences during market stress. The HDFC funds mentioned above, with downside capture ratios in the high 70s to low 80s, provide substantially better downside protection compared to funds with ratios in the 90s or above.

Beyond the Numbers: What This Means for Your Portfolio

Downside capture ratios reveal fund managers' risk management philosophies and their ability to preserve capital during adverse market conditions. Fund managers who consistently deliver low downside capture ratios demonstrate several key capabilities: active risk management, quality stock selection that holds up better during stress, and tactical asset allocation skills that help navigate market volatility.

The consistency of downside protection over different time periods also matters significantly. The HDFC Mid-Cap Opportunities Fund's track record of maintaining strong downside protection across 3, 4, and 5-year periods suggests systematic risk management rather than temporary luck.

The Road Ahead: Building a Complete Evaluation Framework

Understanding downside capture is just the beginning of sophisticated fund evaluation. In the upcoming articles in this series, we'll explore other crucial metrics that most investors ignore: upside capture ratios, rolling returns analysis, risk-adjusted performance measures, and consistency metrics that reveal the true quality of fund management.

The goal isn't to completely dismiss returns data, but rather to view it within a comprehensive framework that considers risk, consistency, and capital preservation alongside growth potential. After all, the best fund isn't necessarily the one with the highest returns—it's the one that delivers solid performance while helping you sleep well at night, even during market storms.

Remember, in investing, it's not just about how much you make when times are good—it's about how much you keep when times get tough.