SIP Sahi Hai? But Kab Tak? Understanding Sequence Risk for Retirees in India

Sequence Risk in Retirement Planning: Lessons from Market Volatility and Withdrawal Strategies

In India’s retail investment landscape, the ubiquitous "SIP Sahi Hai" has become a mantra, urging investors to "never stop SIPs" regardless of life stage or market conditions.

However, this one-size-fits-all narrative is creating a hidden crisis for retirees and pre-retirees. Aggressive mis-selling of equity SIPs to seniors—often without assessing risk tolerance or exit timelines—has left thousands vulnerable to sequence risk, where market downturns can irreversibly deplete lifelong savings. Recent SEBI directives highlight this systemic issue, with the regulator flagging cases of distributors pushing small-cap funds and high-risk SIPs to retirees.

This April 2025 market crash exposed this fragility: retirees who continued SIPs in equity-heavy portfolios faced a double blow—depleting capital through withdrawals while their remaining investments plummeting every single day. Yet, the industry rarely addresses the critical question: "SIP kab tak sahi hai?".

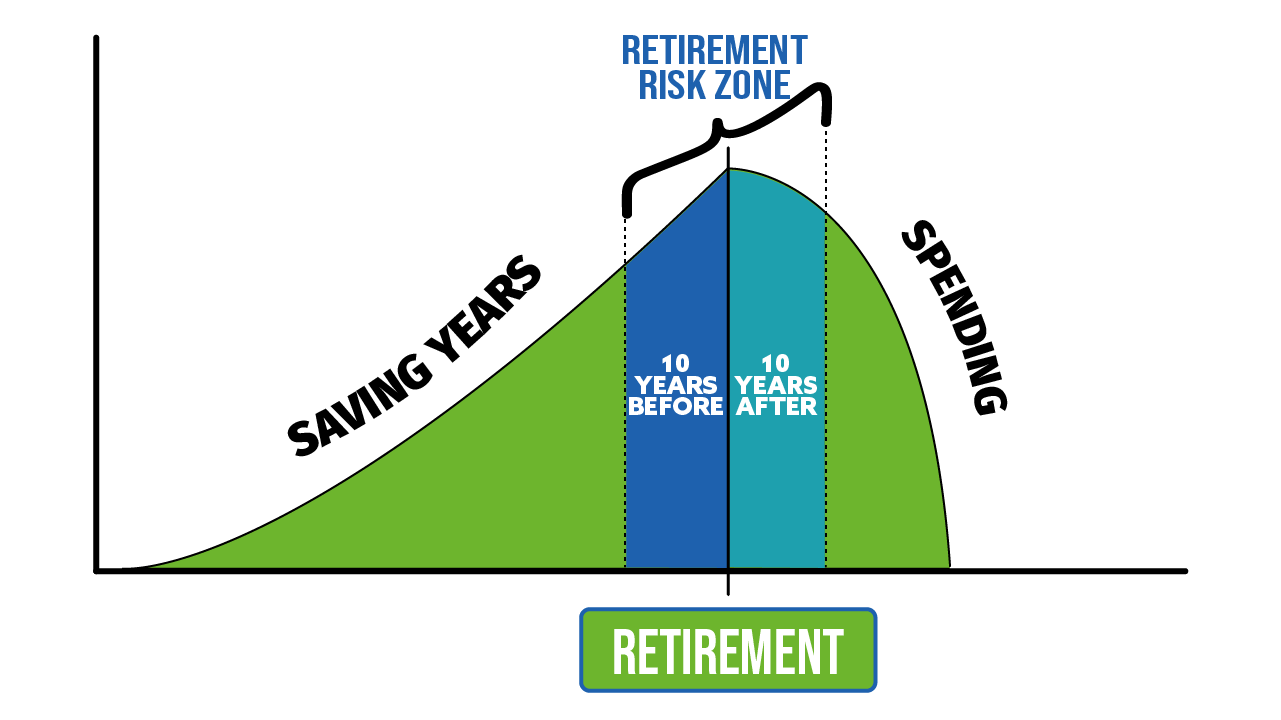

Working closely with many retirees and pre-retirees, I see that they focus on average returns when planning their retirement. However, what truly matters is not just how much your investments earn, but when those returns occur. This phenomenon, known as sequence risk, can have a profound impact on the sustainability of your retirement corpus. Recent events in the Indian stock market, serve as a stark reminder of how market volatility can exacerbate sequence risk.

Understanding Sequence Risk

Sequence risk, or sequence-of-returns risk, arises when negative investment returns occur early in your retirement or during the withdrawal phase of your portfolio. Even if the average return over time is favorable, early losses combined with withdrawals can deplete your corpus faster than anticipated. This leaves less capital to recover when markets rebound.

For instance:

If you experience a 10% loss in the first year of retirement and withdraw funds simultaneously, the impact is far greater than if the same loss occurred later when your corpus is smaller.

The timing of returns becomes critical because withdrawals during a downturn lock in losses permanently.

Understanding Sequence Risk: Accumulation vs. Withdrawal

Sequence risk manifests differently depending on whether you’re saving for retirement (accumulation phase) or drawing from your corpus (withdrawal phase).

Accumulation Phase

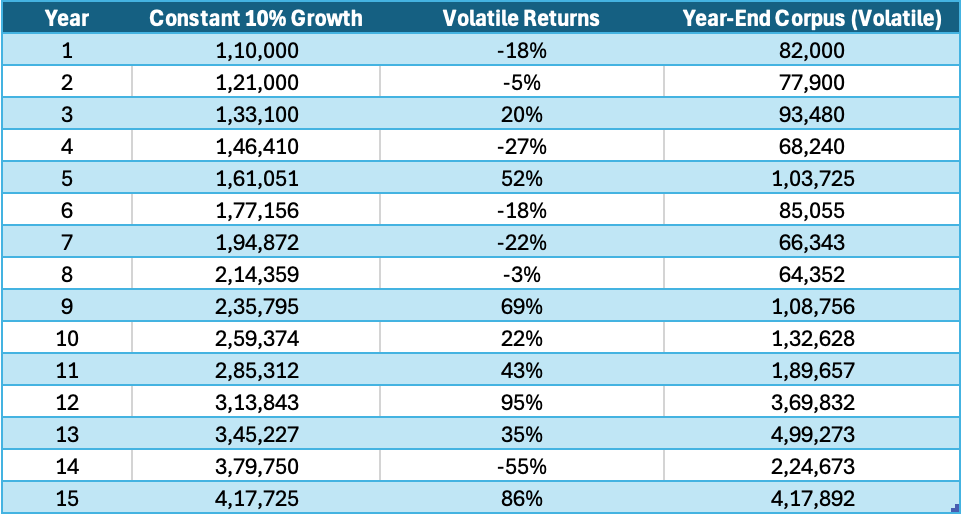

Consider Rahul, a 35-year-old investing ₹1 lakh lump sum in equities for 15 years. The inherent volatility nature of equity investing gets masked when we hear the phrase “On an average equities have returned 10% over a period of 15 years.” There is a stark difference between earning a constant 10% return on our investment vs. the actual return in equities as outlined in below table. Even though the final corpus is similar, but the path taken to the final number is contrastingly different.

Withdrawal Phase: The Real Danger

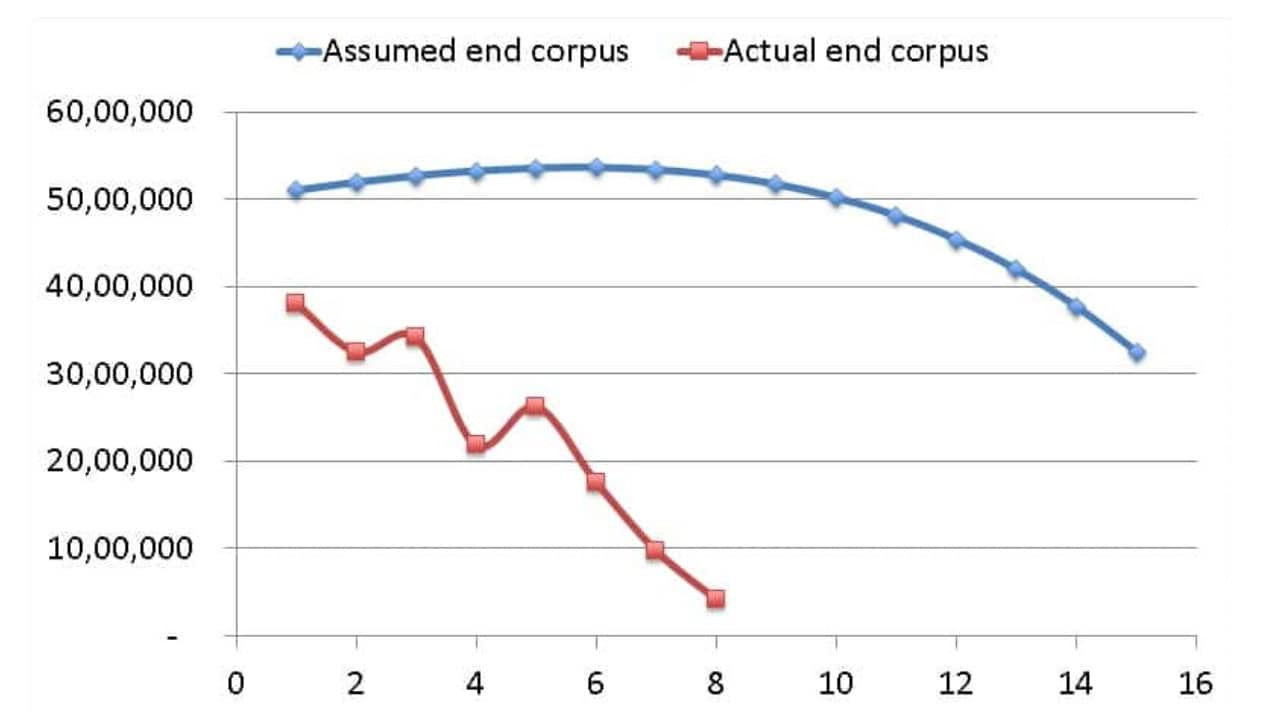

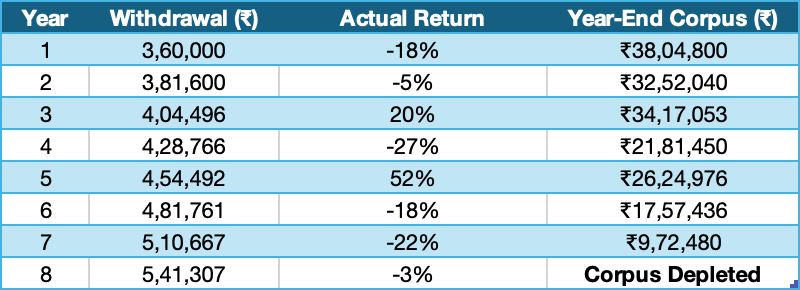

Sequence risk becomes catastrophic during retirement withdrawals. Let’s examine Priya, a 60-year-old retiree with ₹50 lakh, withdrawing ₹3.6 lakh annually (increasing by 6% for inflation).

As you navigate the complexities of retirement planning—whether it’s transitioning to safer assets or balancing risk and growth—it’s crucial to have a clear strategy tailored to your goals. If you’re unsure about how the recent market crash has impacted your financial future, Sabiduria Capital can guide you toward a secure and resilient portfolio.

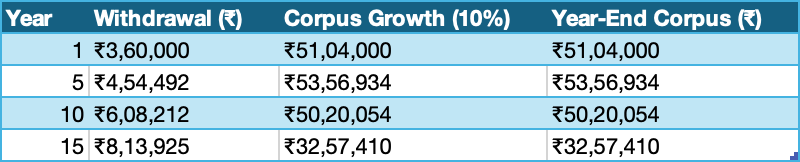

Scenario 1: Constant 10% Returns:

In this hypothetical scenario, Priya starts with a ₹50 lakh corpus, withdrawing ₹3.6 lakh annually (increasing by 6% each year for inflation). Assuming a constant 10% annual return, the corpus grows steadily despite withdrawals. For example:

Year 1: After withdrawing ₹3.6 lakh, the remaining ₹46.4 lakh grows to ₹51.04 lakh.

Year 15: Despite annual withdrawals rising to ₹8.13 lakh, the corpus retains ₹32.57 lakh due to consistent growth.

This illustrates how stable returns allow the portfolio to outpace withdrawals, preserving capital over time.

Scenario 2: Volatile Returns (Real-World Sequence)

Using the same initial corpus and withdrawal strategy but substituting actual returns from above (-18%, -5%, +20%, etc.), the outcome is catastrophic:

Year 1: A -18% return reduces the post-withdrawal corpus to ₹38.04 lakh.

Year 8: After successive losses (-5%, -22%, -3%), the corpus plummets to ₹4.18 lakh, insufficient to cover the ₹5.41 lakh withdrawal. The portfolio is fully depleted by Year 8.

The stark contrast arises from early negative returns, which force the retiree to sell more units at depressed prices, irreversibly shrinking the corpus. Even later rebounds (+69% in Year 9) cannot compensate, as the remaining capital is too small to recover.

Sequence risk transforms mathematically identical long-term returns (10% CAGR in both scenarios) into vastly different outcomes. In India’s volatile markets—exemplified by the April 2025 crash—retirees must prioritize asset allocation and withdrawal flexibility to avoid premature depletion.

4 Strategies to Mitigate Sequence Risk in India

1. Dynamic Asset Allocation: Shift from Equity-Centric Portfolios

Pre-retirement de-risking: Reduce equity allocation annually starting 5–10 years before retirement.

Example: At age 55, shift from 60% equity/40% debt to 30% equity/70% debt by age 60.

Post-retirement allocation: Maintain 30–40% in equities for growth, 40–50% in debt (e.g., FDs, Senior Citizen Savings Scheme), and 10–20% in gold/liquid assets.

Why it works: Bonds and FDs provide stable returns during downturns, reducing reliance on equity sales. During the April 2025 crash, retirees with 60% debt allocations withdrew from fixed-income assets, preserving equities for recovery.

2. The Bucket Strategy: Segregate Corpus by Time Horizon

Structure:

Bucket 1 (1–3 years): Cash, FDs, liquid funds (e.g., ₹10–15 lakh for immediate needs).

Bucket 2 (4–7 years): Short-term debt funds, corporate bonds, or hybrid funds.

Bucket 3 (8+ years): Equity mutual funds, Nifty 50 ETFs.

Result: During the April 2025 crash, withdrawals from Bucket 1 spared equities from being sold at a 5% loss.

3. Stress-Test Your Portfolio: Simulate Worst-Case Scenarios

Monte Carlo simulations are a critical tool for retirees to evaluate sequence risk, especially given the market’s inherent volatility and structural challenges like high inflation (6–7% vs. 2–3% in developed markets). These simulations run 1,000+ randomized return sequences—including extreme events like the 2008 crash, COVID-19 sell-off, and April 2025 correction—to quantify the probability of a portfolio surviving retirement.

Example: A ₹2 crore portfolio with 50% equity/50% debt has a 90% survival rate over 30 years at 4% withdrawals but drops to 60% at 6%. While a 4% withdrawal rate may seem conservative, India’s inflationary environment and equity volatility demand a more cautious 3–3.5% rate.

4. Behavioral Guardrails: Avoid Emotional Decisions

Common pitfalls:

Panic-selling equities during crashes (e.g., April 2025).

Overcorrecting to ultra-conservative allocations (e.g., 100% FDs), which invite inflation risk.

Solutions:

Automate rebalancing: Use scheduled systematic transfers/withdrawals to maintain target allocations.

Commit to a written plan: “I will not sell equities during a >20% correction.”

Conclusion

Sequence risk is particularly relevant for Indian retirees given the volatility of our markets and reliance on equity-linked instruments like mutual funds and stocks for wealth creation. By adopting strategies such as diversification, maintaining liquidity buffers, and using the bucket approach, you can safeguard your retirement corpus against unfavorable market sequences.

As financial advisors often say—it’s not about timing the market but having time in the market. By planning ahead and managing sequence risk effectively, you can ensure that your retirement years are financially secure despite market fluctuations.

If you’ve been impacted by the recent market volatility, such as the April 2025 crash, and are concerned about how it might affect your retirement corpus or investment strategy, we’re here to help. At Sabiduria Capital, we specialize in helping individuals navigate financial challenges and secure their future. Contact us today to get your retirement plan reviewed and ensure your financial independence remains on track.

Visit us at www.sabiduriacapital.com or leave a comment below to discuss your concerns. Let’s work together to secure your financial future, no matter the market conditions.