Riding the Rally, Avoiding the Fall: A Balanced Approach to Upside Capture in Indian Mutual Funds

Learn when to leverage upside capture—and when to prioritize protection—for smarter mutual fund investing in India.

Part 2 of the "Beyond Returns" Series

In my previous article, we explored how downside capture ratios reveal the true defensive strength of mutual funds. Today, we flip the coin to examine upside capture and why chasing funds with exceptionally high upside capture ratios can be a dangerous game that costs investors more than they realize.

Picture this scenario: You're comparing two large-cap funds. Fund X has captured 145% of its benchmark's gains during bull markets over the past three years, while Fund Y has captured a modest 105%. The choice seems obvious—Fund X is clearly superior, right? Not so fast. This seemingly straightforward metric hides several costly traps that can derail your long-term wealth creation.

Understanding Upside Capture: The Basics

Before diving into the hidden dangers, let's establish what upside capture ratios actually measure. The upside capture ratio evaluates how well a mutual fund performs relative to its benchmark during periods when the market is rising. An upside capture ratio above 100% indicates that the fund outperformed its benchmark during bullish periods, while a ratio below 100% suggests underperformance during market upswings.

The calculation is straightforward: divide the fund's returns by the benchmark returns during up-market periods and multiply by 100. For instance, if a benchmark rises 10% in a given period and the fund gains 12%, the upside capture ratio would be 120%.

High upside capture ratios are generally considered desirable because they indicate that the fund manager can generate higher returns than the market benchmark when conditions are favorable . However, the key lies in understanding when this metric serves your investment objectives and when it might work against them.

When to Embrace Higher Upside Capture

Growth-Oriented Investment Goals

If you're investing for long-term wealth creation with a time horizon of 10+ years, funds with higher upside capture ratios can significantly enhance your portfolio's growth potential . An upside capture ratio of more than 100% indicates that the mutual fund has gained more than the benchmark index during bullish periods, which is particularly valuable for growth-focused investors .

For younger investors in their 20s and 30s building retirement corpus, the compounding effect of consistently capturing more upside can be transformative over decades. The ability to participate meaningfully in market rallies becomes crucial when your investment timeline allows you to ride out market volatility.

Aggressive Risk Profiles

If you have a high risk tolerance and can handle portfolio volatility, higher upside capture ratios align well with your investment temperament. Aggressive investors who can withstand short-term fluctuations often prefer funds that can outperform significantly during favorable market conditions, even if this comes with higher volatility.

For business owners or high-income professionals with stable cash flows, the ability to capture maximum upside during good times may outweigh concerns about short-term volatility, especially when they have other income sources to support their lifestyle.

When to Exercise Caution with High Upside Capture

The Volatility Drag Trap

The first and most insidious cost of high upside capture is volatility drag. This phenomenon occurs when higher volatility reduces long-term compounded returns, even when average returns appear attractive . Funds with high upside capture ratios often achieve their outperformance through increased volatility and risk-taking.

Consider this mathematical reality: if an investment drops 50%, it needs a 100% gain just to break even. High upside capture funds, which typically exhibit greater volatility, face this asymmetric recovery challenge more frequently. The arithmetic mean return (what marketing materials often highlight) diverges significantly from the geometric mean return (what your portfolio actually experiences).

Research shows that volatility drag can reduce actual returns by 0.50% for every 10% increase in volatility. For funds with upside capture ratios exceeding 130%, this drag can compound over time, silently eroding the very outperformance that initially attracted investors.

Inadequate Downside Protection

High upside capture becomes problematic when it's not balanced with adequate downside protection. A fund with 150% upside capture but 120% downside capture exposes investors to asymmetric risk where losses during corrections exceed the benefits gained during rallies.

The ideal scenario is finding funds that demonstrate high upside capture (above 110%) combined with low downside capture (below 90%), creating a favorable risk-return profile. When this balance is absent, the high upside capture may not justify the additional risk.

Case Study: Inadequate Downside Protection—A Closer Look at Flexi Cap Funds

When evaluating mutual funds, it's easy to be drawn to those with strong upside capture ratios. However, as the data from the Flexi Cap category shows, high upside capture can sometimes come at the cost of inadequate downside protection—a risk every investor should be aware of.

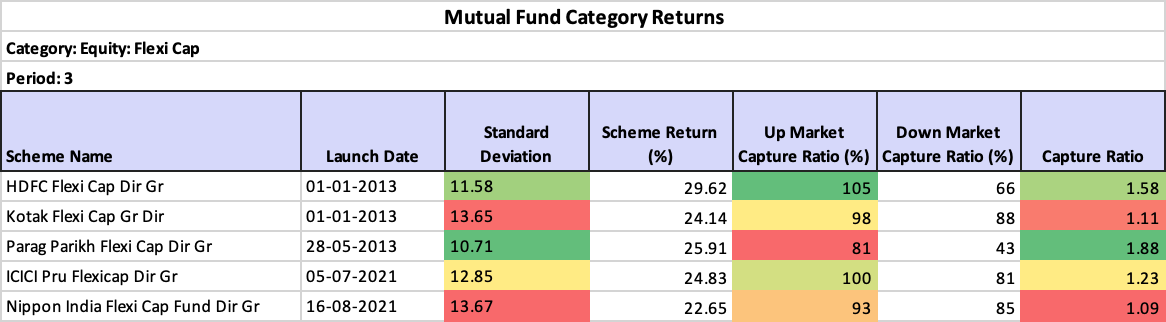

Let’s examine the 3-year performance data for five leading Flexi Cap funds:

HDFC Flexi Cap Dir Gr stands out with an impressive up market capture ratio of 105%, meaning it outperformed its benchmark during bull markets. However, what truly sets it apart is its down market capture ratio of just 66%. This means that during market downturns, it only participated in 66% of the benchmark’s losses—a strong indication of effective downside protection. The result is a strong scheme return of 29.62% with relatively low volatility (standard deviation of 11.58).

Contrast this with Kotak Flexi Cap Gr Dir, which has an up market capture of 98%—slightly below the benchmark—but a down market capture of 88%. This higher downside capture means the fund participated in 88% of the market’s losses during downturns, offering less protection to investors. Despite a decent upside, the relatively high downside capture has contributed to a lower scheme return (24.14%) and higher volatility (13.65).

Parag Parikh Flexi Cap Dir Gr provides another interesting example. With an up market capture of 81%, it doesn’t fully capitalize on bull markets, but its down market capture is an exceptionally low 43%. This means it shields investors from the majority of market declines, resulting in a competitive return (25.91%) and the lowest standard deviation (10.71) among the group.

This case study highlights why it’s crucial to look beyond just upside capture. A fund with a strong upside capture but inadequate downside protection (high down market capture ratio) may expose your portfolio to significant losses during corrections, potentially negating the benefits of outperformance in bull markets. The most resilient funds are those that strike a balance—delivering strong participation in rallies while effectively cushioning the blow during downturns.

When evaluating funds, always consider both sides of the equation. As these examples show, effective downside protection can make a meaningful difference in long-term returns and peace of mind.

Practical Implementation Guidelines

Fund Selection Criteria

Look for funds with upside capture ratios that align with your risk profile and investment timeline. Aggressive investors can consider ratios above 120%, while conservative investors should focus on ratios between 100-115%.

Ensure the upside capture ratio is calculated against an appropriate benchmark that matches the fund's investment mandate. Misaligned benchmarks can create misleading ratios that don't reflect true manager skill.

Portfolio Construction

Use upside capture ratios as one component of a comprehensive evaluation framework that includes expense ratios, fund manager experience, and investment philosophy. High upside capture alone doesn't guarantee superior long-term performance.

Consider the correlation between different funds' upside capture strategies to avoid over-concentration in similar approaches. Diversifying across different upside capture methodologies can provide more stable long-term results.

Monitoring and Review

Regularly review your funds' upside capture performance to ensure they continue meeting your expectations. Market conditions change, and strategies that worked in the past may not be suitable for current environments.

Rebalance your portfolio periodically to maintain your desired allocation between high and moderate upside capture funds. This helps ensure your portfolio remains aligned with your risk tolerance and investment objectives.

Conclusion: The Wisdom of Balance

Upside capture ratio is neither inherently good nor bad. It's a tool that must be used appropriately based on your specific circumstances. The key is understanding when higher upside capture serves your goals and when it introduces unnecessary risk.

For long-term wealth builders with high risk tolerance, embracing higher upside capture can significantly enhance returns. For conservative investors or those with shorter time horizons, moderate upside capture paired with strong downside protection often provides better outcomes.

The most successful investors use upside capture as part of a balanced approach that considers their complete financial picture, risk tolerance, and investment timeline. By matching your upside capture strategy to your specific needs, you can harness this powerful metric to build wealth while managing risk appropriately.

Remember, the goal isn't to find the highest upside capture ratio—it's to find the right balance that helps you achieve your financial objectives while sleeping well at night. This balanced approach to upside capture evaluation will serve you better than either completely avoiding it or blindly chasing the highest ratios.