NRI Retirement Traps: Why Over-reliance on Real Estate Could Jeopardize Your Future

The Dual Mortgage Dilemma: How Owning Homes in Two Countries Traps NRIs in Endless EMIs and Cash Flow Crises

Having worked with numerous Non-Resident Indians (NRIs), I've observed a concerning pattern that threatens the financial security of many NRIs approaching retirement. Among the various pitfalls that can derail retirement plans, one stands out as particularly prevalent and problematic: the overconcentration of investments in real estate. While property ownership in India carries emotional significance and appears to offer stability, the reality often diverges significantly from expectations, creating substantial risks for retirement security.

The Magnetic Pull of Indian Real Estate for NRIs

The attraction NRIs feel toward Indian real estate is understandable and multifaceted. Recent data indicates that NRIs now contribute to approximately 15% of residential property sales in India, with projections showing this figure could rise to 20% by 2025. This popularity stems from both emotional and practical considerations.

For many NRIs, purchasing property represents a tangible connection to their homeland and often serves as a potential retirement home. The Indian real estate market's reputation for appreciation further strengthens this appeal. Additionally, real estate serves as a stable and tangible asset that can diversify an investment portfolio, crucial for NRIs as it helps mitigate risks associated with more volatile investments such as stocks.

However, this compelling narrative often overshadows the complex reality of real estate investment, particularly for retirement planning.

The Reality Behind the Real Estate Retirement Dream

The disconnect between perception and reality becomes evident when examining actual returns. While NRIs meticulously track returns on financial instruments like Fixed Deposits and Mutual Funds, real estate investments remain a mysterious black box, with many investors discovering the true performance of their property investments only years later.

A striking case study revealed that a typical NRI property investment generated merely 6.82% dollar-adjusted return, falling far below both expectations and alternative investment opportunities. This disappointing performance illustrates one of the fundamental problems with over-relying on real estate for retirement.

The Real Estate Trap: A Comprehensive Analysis

Misleading Return Calculations

One of the most common investment blunders made by NRIs is pouring an excessive amount of money into real estate without accurate return calculations. Most property return calculations are overly optimistic as they typically:

Assume 100% occupancy throughout the year if the property is being let out on rent.

Ignore maintenance expenses that grow over time.

Overlook property tax and society charges.

Fail to factor in periodic renovation costs.

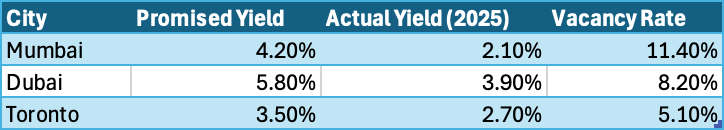

A disproportionate allocation to real estate often leads to disappointingly low rental yields (typically 2-3% in major Indian cities), high maintenance costs, and a cumbersome sales process when liquidity is needed during retirement.

The Management Nightmare

Managing real estate from abroad can be overwhelming for NRIs. Physical distance creates significant challenges in overseeing maintenance, inspecting properties, and interacting with tenants. In fact, 52% of NRIs cite property management as their biggest challenge.

Communication difficulties often necessitate assistance from family members or local contacts, creating additional dependencies and potential conflicts. When issues arise with tenants or maintenance requirements, the NRI investor faces significant hurdles in addressing them promptly and effectively.

Regulatory and Legal Complexities

NRIs face complex regulatory requirements under the Foreign Exchange Management Act (FEMA) when investing in Indian real estate. These regulations strictly control what types of property NRIs can purchase - while residential and commercial properties are permitted, agricultural land, plantation property, and farmhouses are prohibited without special approval from the RBI.

Additionally, property title and ownership disputes represent a significant risk. A landmark Supreme Court case emphasized that property titles must be clear and free from disputes to ensure legitimacy. Many NRIs fail to conduct thorough due diligence, exposing themselves to risks associated with unclear property titles or unresolved encumbrances.

The Liquidity Conundrum

Perhaps the most critical issue for retirement planning is liquidity. Real estate is notoriously illiquid - when retirement expenses require access to funds, selling property can be time-consuming and often results in compromised prices. Market price for properties is consistently 10-15% lower than what property owners believe their assets are worth. This illiquidity creates significant stress during retirement when steady income streams become essential.

The Dual EMI Burden: A Recipe for Financial Immobility

NRIs often fall into a liquidity trap by simultaneously maintaining home loans in their host country and India. Data from 2025 reveals that 42% of NRIs servicing dual mortgages allocate over 45% of their monthly income to EMIs. This leaves minimal cash reserves for emergencies or investments. For instance, an NRI engineer in Silicon Valley paying $3,000/month for a California condo and ₹1.5 lakh/month for a Mumbai apartment would need 11.3 years of continuous employment just to repay principal amounts, excluding interest.

The combination of substantial dual EMIs, low intermediate returns (rental income), high transaction costs, and extreme illiquidity traps NRIs in a cycle of debt repayment. They continuously service loans for assets that provide minimal cash flow and cannot be easily accessed in times of need. This commitment can stretch over decades, consuming financial resources that could otherwise be used for diversified, liquid investments better suited for long-term goals like retirement. In the end, the result is that paper wealth gets tied up in brick and mortar, but remain cash-poor, facing a significant liquidity crunch should unforeseen circumstances arise or when regular income stops post-retirement.

In essence, the dream of owning homes in two countries, financed by loans, often translates into a long-term commitment that severely compromises financial agility and liquidity throughout an NRI's life.

Transaction Delays: The 18-Month Liquidity Black Hole

Indian real estate’s illiquidity manifests starkly when NRIs attempt to exit investments. Unlike stocks that settle in T+2 days, property sales average 18 months in major cities due to:

Title Verification Bottlenecks: 68% of NRI-owned properties face delayed registrations from incomplete documentation.

Price Discovery Challenges: Buyers typically offer 22-27% below quoted rates, forcing sellers into protracted negotiations.

A 2024 case study illustrates this perfectly: An NRI doctor in London attempted to sell her Bengaluru apartment to fund her child’s education. Despite pricing it 15% below market, the property took 23 months to sell, forcing her to take high-interest education loans in the interim.

The Rental Income Mirage: Why Cash Flow Projections Fail

Many NRIs justify dual mortgages by anticipating rental yields. However, ground realities differ sharply:

Beyond Real Estate: Creating a Balanced Retirement Portfolio

A well-structured retirement plan for NRIs should incorporate diversification across multiple asset classes. Asset allocation is the backbone of effective portfolio diversification, helping mitigate risks and optimize returns.

Strategic Asset Allocation Framework

Different asset classes perform differently in various economic environments. While stocks might flourish during economic expansion, bonds often provide stability during downturns. By understanding these correlations, NRIs can better position their portfolios to respond effectively to market changes.

Key considerations should include:

Risk Tolerance: Younger NRIs may prefer more aggressive allocations toward equities, while those nearing retirement should generally lean toward more conservative investments.

Time Horizon: Long-term goals like retirement might justify higher equity allocation, while shorter-term objectives require safer, more liquid investments.

Geographic Diversification: Investing across different markets provides additional protection against country-specific risks.

Alternative Investment Avenues for NRIs

1. National Pension System (NPS)

The National Pension System is a government-sponsored pension scheme available to Indian citizens and NRIs that allows systematic investment toward retirement with a market-based approach. Key features include:

Flexibility to invest in equity, corporate bonds, and government bonds based on risk appetite

Low fund management charges

2. Public Provident Fund (PPF)

While NRIs cannot open new PPF accounts, they can continue contributing to existing accounts opened while they were Indian residents. Benefits include:

Government backing offering assured returns

Tax exemption on interest earned and maturity amount

A structured 15-year investment timeframe suitable for retirement planning.

3. Mutual Funds

Indian mutual funds offer diversification across equities, debt, and hybrid instruments. Advantages include:

Professional management

Choice between equity, debt, and hybrid mutual funds based on risk appetite

Potential for higher returns compared to traditional saving schemes

4. Fixed Deposits

NRE (Non-Resident External) and NRO (Non-Resident Ordinary) fixed deposits offer secure investment options with predictable returns. NRE deposits offer full repatriation with tax-free interest, while NRO accounts are suitable for income earned in India, though subject to TDS.

Practical Action Steps for NRIs

1. Assess Your Current Real Estate Allocation

Evaluate what percentage of your retirement portfolio is currently allocated to real estate investments. If it exceeds 30-40%, consider strategies to diversify gradually.

2. Calculate True Returns

Look beyond simple appreciation figures and calculate your actual returns, accounting for all expenses, taxes, and currency fluctuations. Compare these with returns from other asset classes to make informed decisions.

3. Address Management Challenges

If maintaining real estate investments, establish reliable property management systems, either through professional services or trustworthy contacts in India.

4. Establish Regulatory Compliance

Ensure all real estate investments comply with current FEMA regulations and that proper documentation is maintained for tax and legal purposes.

5. Create a Diversification Roadmap

Develop a plan to gradually diversify your portfolio across multiple asset classes, ensuring adequate liquidity for retirement needs.

Conclusion

While real estate can be a valuable component of a retirement portfolio, over-reliance on this single asset class creates significant risks for NRIs approaching retirement. The combination of management challenges, regulatory complexities, poor liquidity, and often disappointing actual returns makes diversification essential.

By adopting a balanced approach to retirement planning, incorporating various investment vehicles suitable for NRIs, and carefully assessing the true costs and benefits of real estate holdings, NRIs can create more resilient retirement portfolios. The most effective retirement strategies embrace diversification not just as a defensive measure, but as a proactive approach to optimizing returns while managing risk appropriately.

Remember that retirement planning is highly personalized, and strategies should be tailored to individual circumstances, time horizons, and risk tolerances. Seeking professional guidance can help navigate the complexities of cross-border retirement planning and ensure your golden years are financially secure, regardless of which country you choose to call home.

Navigating cross-border retirement planning requires expertise in both Indian regulations and global wealth management strategies. At Sabiduria Capital, we specialize in helping NRIs untangle complex liquidity traps through tailored portfolio diversification, regulatory compliance audits, and phased exit strategies for underperforming real estate assets. Our goal is to transform stagnant property holdings into dynamic, income-generating portfolios that align with your retirement timelines and risk appetite. To explore how we’ve helped NRIs reclaim financial flexibility, visit sabiduriacapital.com for a free liquidity health check or leave a comment down below and we will reach out to you.