Breaking Free from Caged Capital: Why Global Diversification is the Key to Unlocking Wealth for Indian Investors

Liberating Your Wealth: Hard Numbers on Why the LRS Quota Is Your Portfolio's Best Friend

Ever wanted to invest in groundbreaking AI technologies before they transform industries? Or wondered how to position your portfolio to benefit from EU green energy initiatives? Perhaps you've considered capitalizing on the global EV revolution but found yourself restricted to watching from the sidelines? As an Indian investor, you've likely felt the frustration of seeing opportunities in the American semiconductor leader like Nvidia or European luxury giants like LVMH, only to find yourself locked behind regulatory barriers and currency controls.

This investment FOMO isn't just psychological—it's financial. While your capital remains caged within domestic borders, global wealth creation continues unabated. Whether it's Chilean lithium miners powering the battery revolution or Nordic clean tech innovators transforming energy markets, the most exciting investment stories of our decade often unfold beyond Indian exchanges.

Indian investors have long exhibited a strong preference for domestic assets, with over 90% of portfolios concentrated in local stocks, real estate, and gold. This home bias—the tendency to overweight investments in one's home country—persists despite India representing just 3% of global market capitalization. While familiarity and regulatory ease drive this behavior, it exposes portfolios to concentrated risks, from rupee volatility to sector-specific downturns.

This article explores how Indian investors can strategically diversify globally while navigating regulatory frameworks like the Liberalised Remittance Scheme (LRS) and tax collection at source (TCS) rules.

Caged Capital: The Double-Edged Sword of Domestic Confinement

The Invisible Chains: What Keeps Indian Money Local?

Caged capital refers to investment funds trapped within national borders due to regulatory barriers, cultural preferences, or systemic inefficiencies. In India, this manifests through:

Regulatory caps: SEBI's $7 billion limit for mutual funds (MFs) investing overseas, which forced funds like Axis Global Equity to halt subscriptions in 2024.

Currency controls: The LRS allows only $250,000/year for foreign investments, creating artificial scarcity in global exposure.

Behavioral barriers: A 2025 study revealed 68% of Indian investors consider foreign markets "too complex," preferring the perceived safety of domestic assets.

This home bias isn't irrational—it's reinforced by historical returns. The Nifty 50 delivered 14% annualized returns over the past decade, outperforming many global indices.

However, this creates a dangerous illusion of safety. During the 2024 domestic market correction, globally diversified portfolios fell 9% less than India-only holdings.

The Numbers Don't Lie: Quantifying the Global Advantage

The Return Enhancement Effect

Recent data from Ionic Wealth (as of February 2025) demonstrates how global diversification transforms portfolio returns across different time horizons. Their analysis tracks portfolios with varying allocations to global equities (primarily S&P 500 and Hang Seng) compared to a pure Nifty 50 portfolio:

One-year returns: A pure Nifty 50 portfolio returned just 0.8%, while adding 50% global exposure boosted returns to 15.2%—a nearly 19-fold increase.

Two-year returns: Global diversification increased returns from 13.1% (pure Nifty) to 19.5% (50% global allocation).

Five-year perspective: Even over longer horizons, global exposure enhanced returns from 14.6% to 16.0%.

These figures clearly demonstrate that global diversification isn't just about risk reduction—it's about return enhancement. Each 10% increment in global allocation delivered progressively higher returns across nearly all time periods, with the most dramatic improvements seen in shorter timeframes when Indian markets faced headwinds.

The Currency Effect: What INR Depreciation Means for Your Returns

When evaluating global investments, currency movements become a hidden return driver. Between 2015 and 2025, the Indian Rupee weakened from ₹61.65 to ₹87.50 per USD—a 42% depreciation. This currency slide means:

A ₹1 lakh investment in Nifty 50 in 2015 grew to ₹2.66 lakhs by 2025 (165.6% return in INR).

However, in USD terms, this same investment grew from $1,622 to only $3,043—just 87.1% growth.

The annualized return dropped from 10.25% in INR to 6.46% in USD.

By contrast, US market investments automatically incorporate this currency advantage. When the rupee depreciates 3.5% against the USD (as it did in the past 6 months), a US investment gains an additional 3.5% when converted back to rupees—even if the underlying investment remains flat.

International Mutual Funds: Convenience vs. Constraints

For Indian investors seeking global diversification without the complexities of direct stock trading, mutual funds investing in international markets offer a convenient solution.

These funds allow you to gain exposure to global equities, such as the U.S. tech-heavy NASDAQ 100 or China’s emerging market giants, while leveraging professional fund management and avoiding the operational challenges of currency conversion and foreign brokerage accounts.

However, while they simplify the process, they come with limitations that must be carefully considered.

The Pros: Simplicity for the Cautious Investor

Plug-and-play diversification: Funds like Motilal Oswal NASDAQ 100 FoF offer one-click exposure to U.S. tech giants, with expense ratios under 1%.

Rupee averaging: SIPs as low as ₹500/month let investors benefit from dollar-cost averaging without navigating forex markets.

The Cons: Hidden Pitfalls

Supply crunches: When SEBI's $7 billion cap was hit in 2024, funds like ICICI Prudential U.S. Bluechip Equity closed to new investors, stranding SIP plans.

Premium traps: ETFs like Nippon India Japan Equity traded at 12% premiums due to limited units, eroding returns for late entrants.

Sector skews: 80% of global MFs focus on U.S. tech, neglecting emerging opportunities in AI infrastructure or European renewable energy.

Accessing Global Markets Directly:

For Indian investors looking to invest directly in international markets, there are two primary options: using Indian brokers with international tie-ups or opening accounts with foreign brokers that accept Indian clients. Indian brokers like ICICI Direct, HDFC Securities, and INDmoney simplify the process by partnering with international institutions, allowing investors to trade foreign stocks through their existing platforms. These brokers handle currency conversion and compliance with Indian regulations, making it a seamless experience for those new to global investing.

Alternatively, investors can open accounts directly with foreign brokers such as Interactive Brokers (IBKR), or Charles Schwab International. These platforms provide access to a broader range of global securities, including U.S. stocks, ETFs, and niche instruments like European bonds or Japanese REITs. While foreign brokers offer greater flexibility and lower trading costs for active investors, they require navigating additional steps like funding accounts via wire transfers. Both options have their merits, and the choice depends on the investor's goals, portfolio size, and comfort level with international platforms.

Why Go Direct?

Uncapped exposure: Buy Tesla shares or German solar bonds without MF restrictions.

Cost savings: Trade U.S. stocks for $0.005/share vs. 1% TER in MFs.

Niche strategies: Short Nvidia during AI hype cycles or hedge INR using EUR/INR futures.

LRS and TCS: Navigating the Tax Maze:

The Liberalised Remittance Scheme (LRS), introduced by RBI in 2004, allows resident Indians to remit up to USD 250,000 per financial year for various permissible transactions including investments, education, medical treatment, and travel abroad. This scheme has helped Indians overcome international fund transfer restrictions set by FEMA, enabling portfolio diversification and access to global opportunities.

Tax Collected at Source (TCS) is essentially a prepaid tax collected by banks when you send money abroad under LRS, which can later be adjusted when filing your income tax returns. As per Budget 2025, TCS is applicable at 20% for general remittances exceeding ₹10 lakh (increased from the earlier ₹7 lakh threshold) and at 5% for education and medical purposes, though education remittances funded through loans from specified financial institutions are now exempt.

2025 Rule Changes Simplified

Increased thresholds: No TCS on remittances up to ₹10 lakh/year (vs. ₹7 lakh earlier).

Education exemption: TCS waived for tuition fees if the amount being remitted is from education loan obtained from a specified institution.

Post-₹10 lakh rates:

5% for medical/education

20% for investments/travel

Finding the Optimal Allocation: The Science of Diversification

The Efficient Frontier: Beyond Gut Feelings

Modern portfolio theory offers a scientific approach to global diversification through the concept of the "efficient frontier"—the set of portfolios that maximize expected returns for a given level of risk. Research comparing NIFTY, S&P 500, and Hang Seng indices reveals:

Volatility differences: From 2010-2022, NIFTY exhibited annualized volatility of 22.95%, compared to just 15.85% for the S&P 500—highlighting how U.S. markets can actually lower a portfolio's overall risk.

Risk-reward profile: Despite NIFTY's impressive 221.36% accumulated return, the S&P 500 delivered 389.38% with significantly less volatility, resulting in a superior Sharpe ratio (0.43 for NIFTY vs. higher for S&P 500).

Downside protection: Maximum drawdown (the peak-to-trough decline) for NIFTY reached 36.54%, making global diversification critical during market stress.

Low Correlation: The Secret Sauce of Diversification

One of the most powerful aspects of global diversification is the low correlation between Indian and international markets. Research from the Indian Journal of Marketing reveals:

Correlation analysis: NIFTY 50 and NASDAQ 100 exhibit relatively low correlation, creating enhanced diversification opportunities.

Improved risk profiles: When combining markets with low correlation, investors need more assets in their portfolio to diversify unsystematic risk effectively.

Foreign capital relationship: Correlation structures between indices influence foreign portfolio investment flows into India, creating a virtuous cycle.

The Magic of 50:50: Optimizing for Risk-Adjusted Returns

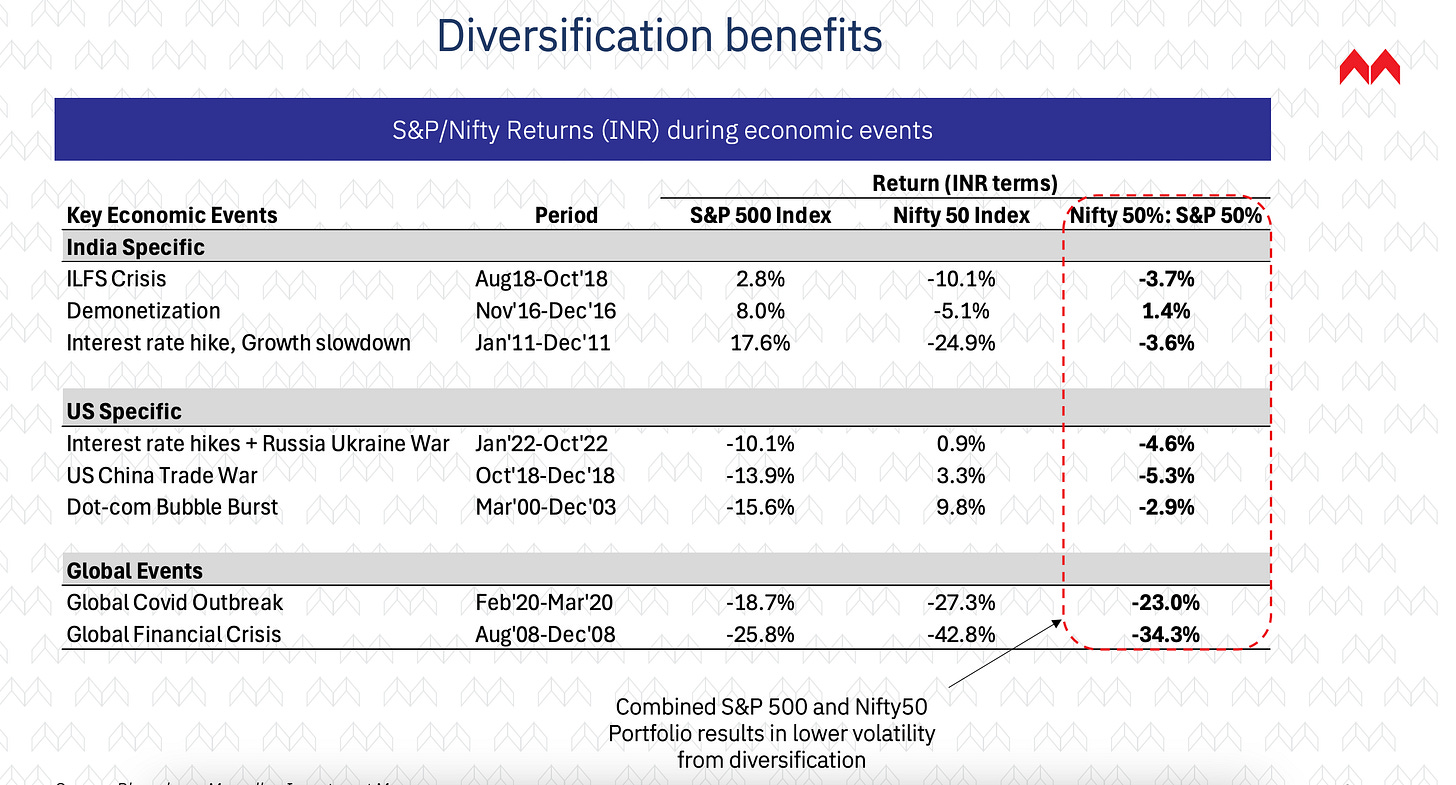

Recent studies by Marcellus Investment Managers (analyzing data from 2004-2024) found that an equal-weighted 50:50 allocation between NIFTY 50 and S&P 500 significantly improves risk-adjusted returns compared to either market alone. The analysis, which used 3-year rolling periods, showed:

Lower downside risk: The combined portfolio experienced substantially reduced negative standard deviation compared to NIFTY alone.

Better return-to-risk ratio: The blended portfolio delivered more return per unit of risk.

Consistent outperformance: The 50:50 mix outperformed pure India exposure across most 3-year rolling periods.

The Home Bias Trap: Why Your Brain Fights Diversification

The Psychology of Staying Local

Familiarity fallacy: 74% of Mumbai investors prefer Tata over Apple, citing "understanding the business".

Media myopia: Endless coverage of Reliance deals vs. sparse reporting on EU carbon markets.

Recency bias: After 2023's 22% Nifty surge, 61% investors believed domestic stocks were "safer".

Breaking the Cycle

Education: Use tools like IBKR's demo account to simulate global trading.

Start small: Allocate 5% to global MFs, gradually increasing as comfort grows.

Automate: Set quarterly rebalancing alerts to maintain 70-30 India-global splits.

Low-Cost Global ETFs: The Building Blocks of International Diversification

For Indian investors ready to implement global diversification, several cost-efficient options exist through both international brokers and domestic fund-of-funds (FoFs). The Vanguard Total Stock Market ETF (VTI) stands out as a premier choice, offering exposure to over 3,600 companies across developed and emerging markets with a modest expense ratio of just 0.03%. This single ETF provides truly comprehensive global coverage, including U.S., European, and Asian markets in one convenient package.

Similarly, the Invesco FTSE All-World UCITS ETF charges just 0.15% annually while tracking the same index. Investors preferring U.S.-focused exposure can consider the Vanguard S&P 500 ETF with ultra-low expense ratios of 0.03%. For developed markets excluding the U.S., the Vanguard FTSE Developed Markets ETF (VEA) offers broad exposure at just 0.05%. Indian investors can access these ETFs through international brokers using their LRS quota.

Alternatively, several domestically available options provide similar exposure: Kotak Nasdaq 100 FoF and Mirae Asset S&P 500 Top 50 ETF FoF offer U.S. market exposure. For diversified global allocation, mutual funds like Bandhan US Equity FoF and Edelweiss Europe Dynamic Equity Offshore Fund provide targeted regional exposure. List of funds still open to Indian Investors can be found here: Link

When selecting between direct international investments and domestic FoFs, consider that:

Direct investments via foreign brokers offer lower expense ratios (0.03-0.22% vs. 0.57-1.79% for domestic FoFs).

Domestic FoFs simplify administration but often carry higher expense ratios and may face investment caps.

For most investors with portfolios exceeding ₹50 lakh, the cost savings from direct international investment typically outweigh the added complexity, especially when implementing the optimal 50:50 domestic-international allocation.

Conclusion: From Nifty to Thrifty

Global diversification isn't about abandoning India—it's about insulating your wealth from local shocks while participating in worldwide growth. The data is clear: allocating even 30-50% of your portfolio to global equities can dramatically improve both returns and risk-adjusted performance.

Remember that the rupee's consistent 3-4% annual depreciation against the dollar provides an additional tailwind for international investments. When combined with the lower correlation between global markets, this creates what investment professionals call "the only free lunch in finance"—higher returns with lower risk.